Drawing analogies to an epic tennis match and the hands of a clock, the leader of Bermuda-based Arch Capital declared the current hard market one of the longest the P/C industry has ever experienced.

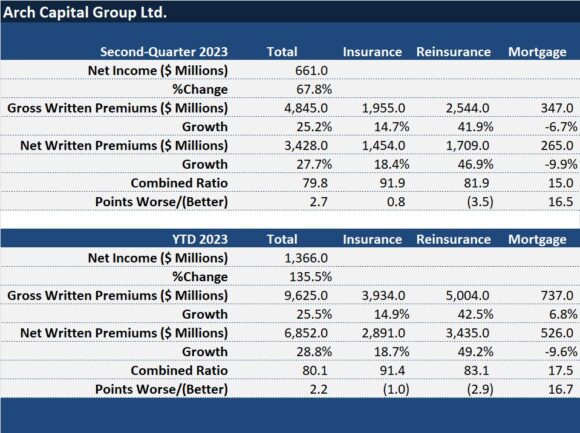

“This is the type of well-rounded quarter we have always envisioned,” Arch Chief Executive Officer Marc Grandisson told analysts and investors late last week, as the Bermuda-based company reported second-quarter underwriting income of more than $100 million in each of the three segments in which the company participates: insurance, reinsurance and mortgage.

Reinsurance results showed the greatest hard market-driven improvement, with underwriting income up 75% to $245 million, translating to an 82.8 combined ratio as net premiums for the segment jumped nearly 47% to $1.7 billion.

“Last year, a popular topic on earnings calls was whether rate increases were slowing or whether the rates were even decreasing,” Grandisson said. He went on to reference a pivotal game in a recent Wimbledon match between Carlos Alcaraz and Novak Djokovic to make his point that the chatter is premature and that the current hard market is still in full swing.

The tennis match lasted nearly five hours, and a single game in the third set lasted more than 26 minutes, instead of the usual three or five minutes, Grandisson reported. “It was an incredible display of tenacity and athleticism. Not to mention the mental strength required to remain focused…But what really stuck with me was that kind of like this hard market, the game simply refused to end.” While there were many times when a single winning shot would have ended the game, “it just kept going.”

“About 15 minutes in, it became clear that we just needed to enjoy what we were watching and not focus on the end point,” he said. “That’s what we’re doing with this hard market, returning what the market serves us with gusto.”

Earlier in the call, Grandisson invited listeners to download a diagram of an insurance clock for another view of the market. The clock was created by Paul Ingrey, a founding member of Arch Capital, to help measure the underwriting cycle back when Ingrey was at F&G Re in 1985. Grandisson believes the clock hands today remain positioned at 11 o’clock—a time when most companies show good results as a result of improved rate adequacy.

Referring to last year’s chatter about rate hikes slowing, he said that’s a classic sign of the clock soon hitting 12, “when returns are still very good but conditions begin to soften. Yet here we are in mid-2023 and conditions in most markets remain at 11:00. We’ve even checked the batteries in the clock and they’re just fine. The clock isn’t broken. It’s just that the current environment dictates an extended period of rate hardening,” he said, going on to suggest that heightened uncertainty is sustaining the hard market, as the uncertainty drives an imbalance of supply and demand for insurance coverage.

“Since this hard market inception in 2019, we’ve had COVID, war in Ukraine, increased cat activity and rising inflation, all of which create significant economic uncertainty,” he said, adding that beyond the unknowns of the macro environment, there are industry dynamics at play sustaining hard market conditions. “Generally, inadequate pricing and overly optimistic loss trend assumptions during the soft market years of 2016 through 2019 have led to inadequate returns for the industry,” he said, noting that these factors prompted insurers to raise rates “and purchase more reinsurance in a capacity-constrained market with limited new capital formation.”

“Put it all together, and it may be a while before the clock strikes 12 and we begin to move beyond this hard market,” he said.

Asked to quantify the supply-demand imbalance that exists specifically in the reinsurance market, Grandisson said he believes “$50-$70 billion is not a crazy number.”

In spite of the imbalance, the carriers found ways to do reinsurance transaction and buy coverage. But “there could have been more to be had from a reinsurance perspective,” he said, referring to comments on primary insurer earnings calls about the “sticker shock” they faced, resulting in their need to evaluate how much they could afford based on where the pricing level was.

Focusing on Arch’s property-catastrophe appetite, an analyst asked about Arch’s comfort level for expanding market share and taking on more volatility to move the company’s probable maximum loss percentage to its upper level of risk tolerance.

Grandisson said, “We’re in the early innings of where it’s going to go…”

“These are the early innings of our market getting much better,” he said, noting that improved terms and conditions, as well as pricing, is helping the industry to manage catastrophe-related risk better.

Later in the call, the CEO stressed that the hard market is not limited to property-catastrophe coverages. He made note of the fact that Arch’s facultative property team saw increased submissions during the first half of the year, adding that the fac portfolio is not a cat-heavy book and suggesting that “facultative is typically, in any market, a good indication for where the market psychology is.”

Globally, the market “psychology of the last quarter is squarely in the camp of having to mend and optimize and reshape and reunderwrite the portfolio,” he said. “Beyond the cat, when you provide fire protection, the pricing and the conditions are improving there as well,” he said, referring to a “broad-based” hard market.

Photograph: Spain’s Carlos Alcaraz celebrates after beating Serbia’s Novak Djokovic to win the final of the men’s singles on day fourteen of the Wimbledon tennis championships in London, Sunday, July 16, 2023. (AP Photo/Kirsty Wigglesworth)

This article first was published in Insurance Journal’s sister publication, Carrier Management.

Topics Pricing Trends Market

Was this article valuable?

Here are more articles you may enjoy.

Political Violence in Polarized US at Its Worst Since 1970s

Political Violence in Polarized US at Its Worst Since 1970s  Average Cost of a Data Breach Has Reached an All-Time High: IBM Report

Average Cost of a Data Breach Has Reached an All-Time High: IBM Report  ChatGPT Fever Spreads to US Workplace, Sounding Alarm for Some

ChatGPT Fever Spreads to US Workplace, Sounding Alarm for Some  Kemper Exits Preferred Home and Auto Business Immediately

Kemper Exits Preferred Home and Auto Business Immediately