Systemic shocks related to the recent pandemic, the war in Ukraine, natural catastrophe losses and elevated inflation have raised questions about reserve adequacy for property/casualty insurers, according to a Swiss Re report.

These recent shocks have pushed up claims and added to reserving uncertainties, which may lead insurers to reduce their risk appetite, new business capacity and require more premium to cover – factors that could extend or exacerbate the current hard market, said the Economic Insights report titled “Reserving: higher uncertainty puts adequacy in the spotlight.”

As a result of these uncertainties, direct insurance reserve releases in advanced markets are slowing after a decade of favorable progress, the report said, noting that insurers in response have increased the share of incurred-but-not-reported (IBNR) claims.

The report acknowledged that reserve positions are actually elevated by some measures – partly because of insurers’ cautious initial loss estimates for the events of 2020-2021.

“COVID-19 claims estimates have come down from initial calls of up to US$100 billion, to re/insured life and non-life losses of about US$45-50 billion. Lower motor claims frequencies during COVID-lockdowns also contributed to the build-up of excess reserves even after releases for the 2020 and 2021 accident years,” the report explained.

Swiss Re cited the example of U.S. insurers, which reserved cautiously during the pandemic years in anticipation of claims such as those related to cyber and business interruption.

“However, the surge in inflation and other pandemic impacts like court backlogs bring added uncertainty to reserves analysis. On balance, we see higher uncertainty around loss reserves estimates, with downside risks to adequacy,” the report continued. On a positive note, Swiss Re said, high initial estimates of Hurricane Ian’s losses may help ensure sufficient reserves have been booked.

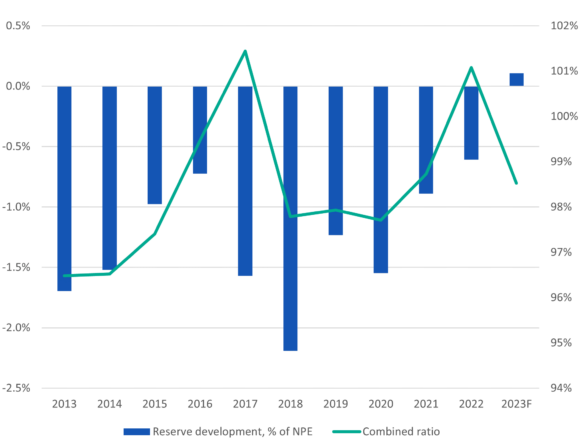

In the U.S., the average reserve development has been a 1% release per year for the past 25 years. (See Figure 1). In the UK, on the other hand, the long-term trend in reserve development has been close to equilibrium, without large releases, while underwriters in continental Europe have historically been conservative in their loss estimates, which brought reserve releases in the years leading up to 2021 that were even larger than the already-large historical average, Swiss Re said.

Despite the current high reserve cushion that exists for insurers in advanced markets, Swiss Re warned that caution is necessary because “the pressures from recent systemic shocks and elevated inflation create more uncertainty, and we believe there is a higher probability that adequacy may weaken.” (See Figure 2).

The report pointed to the fact that the outcome of many COVID-19 court cases remains unknown, and third-party investors are purchasing stakes in the litigation, which could contribute to social inflation. “The war in Ukraine has added to reserve risk, as losses remain highly uncertain in lines that include aviation, political risk, cyber and D&O. While estimates are likely to keep evolving significantly, tentative tallies for Ukraine war-related claims vary around US$10-20 billion.”

High natural catastrophe claims are another factor affecting reserving uncertainties, the report said, adding that the potential for more supply chain issues and shortages makes it harder to predict claims cost increases from demand surge after large natural disasters.

The Economic Insights report was written by James Finucane, senior economist, and Arnaud Vanolli, economist, Swiss Re Institute.

This article first was published in Insurance Journal’s sister publication, Carrier Management.

Topics Pricing Trends Market

Was this article valuable?

Here are more articles you may enjoy.

Kellogg’s ‘Woke’ Workplace Diversity Programs Are Illegal, Group Claims

Kellogg’s ‘Woke’ Workplace Diversity Programs Are Illegal, Group Claims  Wall Street WhatsApp, Texting Fines Exceed $2.5 Billion

Wall Street WhatsApp, Texting Fines Exceed $2.5 Billion  Inflation, Catastrophe Losses Lead P&C Underwriting Loss in 2023

Inflation, Catastrophe Losses Lead P&C Underwriting Loss in 2023  Divers Find 32 Cars Submerged in Lake Near Miami

Divers Find 32 Cars Submerged in Lake Near Miami