Taiwan’s financial institutions reduced their China exposure to a record low amid economic and political uncertainties, according to its top financial regulator.

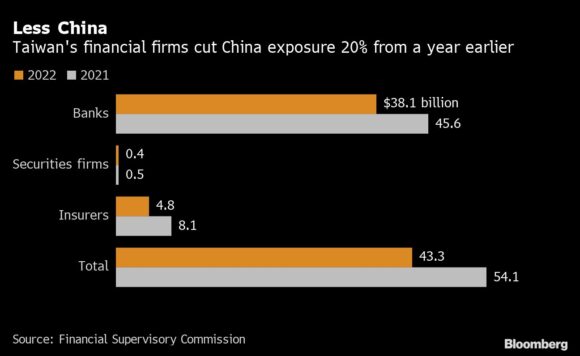

Total exposure to China at Taiwanese banks, insurers and securities firms have dropped by 20% from a year earlier to about NT$1.35 trillion ($43.3 billion) at the end of September, according to Taiwan’s Financial Supervisory Commission.

Taiwan’s government has long urged its businesses to diversify away from the world’s second largest economy. In October, the island’s Finance Minister told Bloomberg News that the export-reliant economy will not “put all our eggs in one basket” and need to work more closely with other trade partners.

Insurers cut over 40% of their China investments to manage risks, according to the FSC. Part of the adjustments were due to the decline of valuations, the FSC said. China’s benchmark Shanghai Composite Index has declined 15% this year.

Meanwhile, Taiwanese banks’ exposure to China dropped 16.5% to NT$1186.9 billion.

“Banks are more conservative on China’s economic outlook,” Sherri Chuang, the FSC’s Banking Bureau Director-General, said in a phone interview, adding that the move also reflects clients’ shifting investment strategy.

Photograph: A pedestrian passes the Taipei 101 building in Taipei, Taiwan, on Tuesday, May 24, 2022. Photo credit: Lam Yik Fei/Bloomberg

Topics China

Was this article valuable?

Here are more articles you may enjoy.

Heritage Insurance Reports Third Straight Quarter of Profit After Shedding Policies

Heritage Insurance Reports Third Straight Quarter of Profit After Shedding Policies  Average Cost of a Data Breach Has Reached an All-Time High: IBM Report

Average Cost of a Data Breach Has Reached an All-Time High: IBM Report  Inflation, Catastrophe Losses Lead P&C Underwriting Loss in 2023

Inflation, Catastrophe Losses Lead P&C Underwriting Loss in 2023  Finance Firms’ Return-to-Office Crackdown Could Backfire: Deloitte

Finance Firms’ Return-to-Office Crackdown Could Backfire: Deloitte