This post is part of a series sponsored by SWBC.

The Federal Emergency Management Agency (FEMA) is responsible for identifying high-risk flood zones, which are then used to designate areas in which homeowners with federally backed mortgages must obtain flood insurance.

In 2021, FEMA’s National Flood Insurance Program (NFIP) fully implemented new procedures for rating flood risk for insurance underwriting purposes. Coined “Risk Rating 2.0,” the new system is intended to reflect risk more accurately for property owners and distribute the cost of insurance for potential flood damage more equitably.

The purpose of Risk Rating 2.0’s broader premise of making rates more actuarially accurate is to make insurance premiums more closely and directly correlated to the actual risk of an individual property and to bring solvency to the government program.

For example, under the previous rating system, there were a multitude of high-dollar, high-risk beach properties for which property owners were paying a relatively low premium on their NFIP policies because the rates were subsidized by lower-risk inland flood properties. FEMA’s original rating methodology didn’t take things like this into account. RR2.0 is going to use data modelling that does.

In the updated system, many of these old ‘grandfathering’ rules and artificial subsidizations the NFIP was providing before RR2.0 have been removed, making private flood insurance much more competitive.

In this blog post, we’ll discuss how FEMA’s new risk rating system may impact your insureds’ need for more primary flood insurance options, and give you tips to share with them to ensure their property is adequately covered.

How Will FEMA’s New Risk Rating 2.0 Impact My Clients’ Coverage and Rates?

In a recent conversation hosted by University of Pennsylvania’s Wharton Risk Center, flood risk analysis experts examined how RR 2.0 could impact coverage for millions of policy holders:

“While homes with existing policies are protected from abrupt price hikes by an 18% per annum legal limit on increases, the law does nothing to protect currently uninsured homes. Due to a variety of systemic challenges around encouraging NFIP participation, this sadly accounts for a majority of homes with high flood risk.

An even more concerning aspect of the low take-up rate is that it appears to be more pronounced for low-income households. This is intuitive since these households are less likely to be able to afford flood insurance in the first place. The median income of non-policyholders in FEMA-established flood zones was found to be just $40,000, barely more than half the $77,000 in median income for policyholders in flood zones. The uncapped rate increases for uninsured homes are almost certain to exacerbate this equity problem and also concentrate market value shocks in communities that are least able to absorb them.

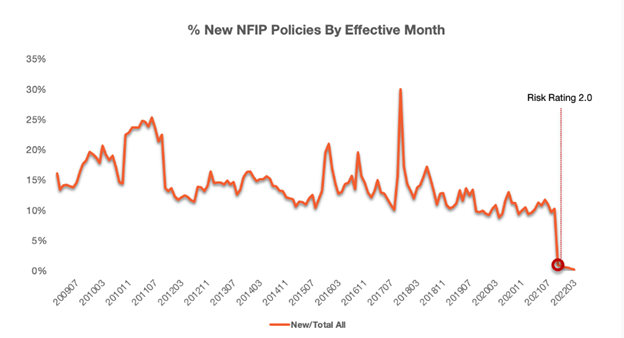

One fear is that uncapped RR 2.0 rates would be unaffordable for new policy applicants (and those that previously lapsed on their policies because they couldn’t afford them) are unfortunately becoming reality, as evidenced by the alarming drop in the number of new NFIP policies created after Phase 1 of RR 2.0 began on 10/1/2021.

This trend has continued into 2022. The chart below shows the percentage of new policies created at the new rates, versus renewals that benefit from protections that delayed increases until 4/1/2022. It seems reasonable to conclude from this analysis that uncapped RR 2.0 rates are significantly higher than the old rates, further discouraging take-up of flood insurance by homeowners.”

Image Source: https://riskcenter.wharton.upenn.edu/lab-notes/riskratingburt/

As you can see, NFIP new policy sales are down compared to pre-RR2.0, but private flood insurance is growing rapidly. One reason for that is because each insurer is willing to take an independent view of risk and those views will often vary to some degree.

Alternatives to NFIP Coverage

As your clients’ trusted insurance agent, they trust you to provide sound advice that will help protect their home. For example, are they aware that flood damage is not covered by homeowners insurance? This is crucial, because, according to FEMA, a mere inch of floodwater in their home can result in over $25,000 in property damage.

If your clients are concerned about rate hikes under FEMA’s new risk rating system, they may want to explore private flood insurance options.

Here are a few highlights of private flood insurance coverage that may help them understand the differences:

Higher Coverage Level: Private flood insurance generally offers a higher level of coverage than NFIP’s $250,000 limit on a home and $100,000 limit on belongings.

Shorter Wait Times: NFIP coverage typically takes 30 days to go into effect, but with some private insurers, coverage could apply in less than a week.

Additional Flood Assistance: If your client has to temporarily relocate, private insurance may provide for short-term housing. Depending on the policy, they could also potentially purchase coverage for items or areas not covered through NFIP.

Hopefully, your clients will never have to use their flood insurance policy—but it’s always best to ensure they have appropriate coverage in case disaster strikes.

SWBC’s excess flood insurance coverage goes above and beyond the standard coverage limits offered by the NFIP. The program also covers funding for living expenses to help the insured through the transition process, which is something the NFIP does not offer.

In addition, SWBC is rapidly expanding coverage to help agents access new private flood insurance options for their clients so that they can offer direct alternatives to the NFIP.

Visit our website to learn more about our excess and private flood insurance options.

Topics Flood

Was this article valuable?

Here are more articles you may enjoy.

Security First Accountant Charged with Siphoning $1.4M Through Fake Invoices

Security First Accountant Charged with Siphoning $1.4M Through Fake Invoices  Maui Fire Is Deadliest in US in 105 Years, With 93 Killed

Maui Fire Is Deadliest in US in 105 Years, With 93 Killed  Kellogg’s ‘Woke’ Workplace Diversity Programs Are Illegal, Group Claims

Kellogg’s ‘Woke’ Workplace Diversity Programs Are Illegal, Group Claims  Could Georgia Be Next With Major Tort Reform? Kemp Calls for Limits

Could Georgia Be Next With Major Tort Reform? Kemp Calls for Limits